Small companies often face a critical dilemma: funding their growth without burdening their finances. Two popular alternatives, inventory financing and purchase order financing, can aid overcome this hurdle. Inventory financing leverages your existing inventory as collateral to secure capital, providing a cash boost for immediate operational needs. On the other hand, purchase order financing enables businesses to secure funds against confirmed customer contracts. While both methods offer distinct advantages, understanding their differences is crucial for selecting the ideal fit for your unique requirements.

- Inventory financing provides quick access to capital based on the value of existing inventory.

- Purchase order financing finances production and fulfillment costs associated with incoming customer contracts.

Whether you're a growing manufacturer, the right inventory or purchase order financing program can be a powerful instrument to fuel expansion, improve cash flow, and capitalize on new possibilities.

Harnessing Momentum for Businesses

Revolving inventory financing offers a powerful mechanism for businesses to boost their operational effectiveness. By providing a continuous source of funding specifically dedicated to managing inventory, this strategy allows companies to leverage opportunities, reduce financial constraints, and ultimately drive growth.

A key strength of revolving inventory financing lies in its flexibility. Unlike traditional loans with fixed parameters, this structure allows businesses to draw funds as needed, responding swiftly to changing market demands and guaranteeing a steady flow of inventory.

- Additionally, revolving inventory financing can release valuable resources that would otherwise be tied up in inventory.{

- Consequently, businesses can direct these resources to other crucial areas, such as research and development efforts, further optimizing their overall performance.

Unsecured Inventory Loans: Is It a Safe Way to Expand?

When it comes to scaling your operations, access to capital is crucial. Companies often find themselves in need of extra resources to address growing requirements. Unsecured inventory financing has emerged as a viable solution for numerous businesses looking to enhance their operations. While it offers several perks, the question remains: is it truly a risk-free option?

- A few argue that unsecured inventory financing is inherently risk-free, as it doesn't necessitate any guarantees. However, there are considerations to evaluate carefully.

- Financing costs can be higher than traditional financing options.

- Furthermore, if your merchandise doesn't sell as anticipated, you could face difficulties in liquidating the loan.

Ultimately, the safety of unsecured inventory financing depends on a variety of factors. It's essential to undertake a thorough analysis of your business's financial health, stock movement, and the terms of the financing offer.

Inventory Financing for Retailers: Boost Sales and Manage Cash Flow

Retailers frequently face a dilemma: meeting customer demand while managing limited funds. Inventory financing offers a approach to this common problem by providing retailers with the funding needed to purchase and stock products. This adjustable financing method allows retailers to increase their stockpile, ultimately boosting sales and customer satisfaction. By accessing supplemental funds, retailers can expand their product offerings, utilize seasonal demands, and improve their overall market position.

A well-structured inventory financing plan can provide several advantages for retailers. First, it enables retailers to maintain a healthy inventory level, ensuring they can meet customer demand. Second, it reduces the risk Inventory Financing for Manufacturers of lost sales due to stockouts. Finally, inventory financing can release valuable cash flow, allowing retailers to deploy funds in other areas of their operation, such as marketing, staff development, or operational enhancements.

Choosing the Right Inventory Financing: A Comprehensive Guide

Navigating the world of inventory financing can be a daunting task for enterprises, especially with the wealth of options available. In order to effectively secure the funding you need, it's crucial to comprehend the various types of inventory financing and how they operate. This guide will present a comprehensive summary of the most common inventory financing options, helping you make the best solution for your specific requirements.

- Evaluate your existing financial situation

- Research the different types of inventory financing available

- Compare the terms of different lenders

- Opt for a lender that satisfies your needs and resources

How Inventory Financing Can Fuel Your Retail Expansion

Inventory financing can be a powerful tool for retailers looking to expand their operations. By using inventory as collateral, businesses can obtain the working capital they need to acquire more merchandise, fulfill increased demand, and launch new stores. This enhancement in cash flow allows retailers to leverage on growth opportunities and attain their business goals.

Inventory financing works by allowing lenders to use the value of a retailer's inventory as collateral for a loan. The loan proceeds can then be used to acquire more inventory, which in turn produces more sales revenue. This process helps retailers retain a healthy cash flow and support their expansion plans.

It's important to note that there are different types of inventory financing options available, such as inventory lines of credit, invoice factoring, and purchase order financing. Each type has its own advantages, so it's important for retailers to choose the option that best fits their needs.

With the right inventory financing strategy in place, retailers can effectively boost their expansion and achieve sustainable growth.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Danielle Fishel Then & Now!

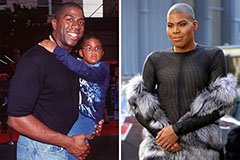

Danielle Fishel Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!